Is it smart to open a Roth IRA?

A Rich Man’s Roth uses a permanent life insurance for cash value to collect tax-free funds over time and allow tax-free withdrawals later. … The Rich Man’s Roth has many benefits, including a reduced risk that taxes will increase over time and have to pay more later.

Can I do a Roth conversion in 2021?

Contents

Conversion limits for the Roth IRA. The government only allows you to contribute $ 6,000 directly to a Roth IRA in 2021 and 2022 or $ 7,000 if you are 50 years or older, but there is no limit to how much you can convert from taxable savings to your Roth IRA in a single year.

Can I still do a Roth conversion? Even if your income exceeds the limits for contributing to a Roth IRA, you can still make a Roth conversion, sometimes called a “backdoor Roth IRA”. You will owe tax on the money you convert, but you will be able to take tax-free withdrawals from the Roth IRA in the future.

What is the deadline for Roth conversions?

Is there a deadline to convert? Yes, the deadline is December 31 this year. A conversion of amounts after tax is not included in gross income. Any converted portion before tax will be included in your gross income for the tax year for conversion.

Can you do a prior year Roth conversion?

There are no provisions from previous years. You can not convert now, but count it as last year. For this reason, those engaged in systematic Roth conversions must make an effort to estimate what their tax may be before the end of the year. We do this for our customers as part of our tax review and Roth conversion services.

Can I do a Roth conversion for 2020 in 2021?

On April 5, you can convert your traditional IRA into a Roth IRA. However, the conversion cannot be reported on your 2020 taxes. Because IRA conversions are only reported during the calendar year, you should report them in 2021.

Are Roth conversions allowed in 2019?

Converting a traditional $ 100,000 IRA to a Roth account in 2019 will result in approximately half of the extra income from the conversion being taxed at 32%. But if you spread the $ 100,000 50/50 conversion over 2019 and 2020 (as you are allowed to do), all the extra income from conversion will probably be taxed at 24%.

What is a good net worth by age?

| Age of family head | Median net worth | Average net worth |

|---|---|---|

| 35-44 | $ 91 300 | $ 436 200 |

| 45-54 | $ 168 600 | $ 833 200 |

| 55-64 | $ 212,500 | $ 1,175,900 |

| 65-74 | $ 266 400 | $ 1,217,700 |

What is the net worth of the top 5%? Net value US percentiles – Top 1%, 5%, 10% and 50% in net value

- The top 1% of net worth in the US in 2021 = $ 10,500,000.

- The top 2% of net worth in the US in 2021 = $ 2,400,000.

- The top 5% of net worth in the US in 2021 = $ 1,000,000.

- Top 10% of net worth in the US in 2021 = $ 830,000.

What is a good net worth number?

A common rule of thumb for deciding what your net worth should be at a given age is to divide your age by 10, and then multiply it by your gross annual income. So if you are 40 years old earning $ 100,000 a year, you should have a net worth of $ 400,000.

Is a net worth of 2.5 million good?

Respondents to the Schwabs 2021 Modern Wealth Survey said that a net worth of $ 1.9 million qualifies a person as wealthy. However, the average net worth of American households is less than half of this. … In fact, the annual Schwab survey found that respondents lower the list of what they consider wealthy.

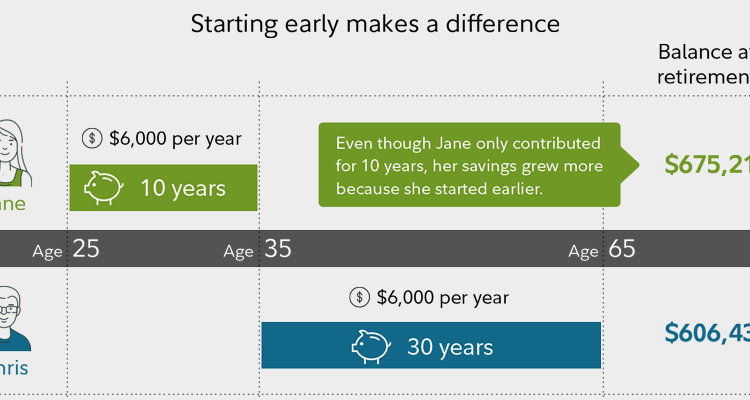

Can a Roth IRA make you rich?

It is possible to reach the million-dollar mark if you start early, contribute consistently and invest in high quality assets. For example, if you commit to contributing $ 6,000 to a Roth IRA each year for 40 years, you can turn $ 240,000 into more than $ 1 million.

Is the Roth IRA Good for High Income? High-wage earners who exceed the annual income limits set by the IRS cannot make a direct contribution to a Roth IRA. … This strategy, known as a backdoor Roth IRA, allows those with high incomes to make indirect contributions.

How much profit can you make in a Roth IRA?

That said, Roth IRA accounts have historically delivered between 7% and 10% average annual returns. Let’s say you open a Roth IRA and contribute the maximum amount each year. If the contribution limit remains $ 6,000 per year for those under 50, you will collect $ 83,095 (assuming a 7% interest rate) after 10 years.

What is the expected rate of return on a Roth IRA?

The Bottom Line Roth IRA is a popular choice for retirement accounts for a reason: They are easy to open with an online broker and historically deliver between 7% and 10% in average annual returns. Roth IRAs take advantage of the mix, which means that even small contributions can grow significantly over time.

Can you get rich from Roth IRA?

Some ultra-rich individuals have amassed hundreds of millions – or even billions – of dollars in tax-protected Roth individual retirement accounts, according to a report released Thursday by ProPublica, an investigative news agency.

Can you get rich off a Roth IRA?

Some ultra-rich individuals have amassed hundreds of millions – or even billions – of dollars in tax-protected Roth individual retirement accounts, according to a report released Thursday by ProPublica, an investigative news agency.

Do millionaires have ROTH IRAs?

Lawmakers find thousands of ‘mega’ IRAs. The answer: almost 25,000 during the tax year 2019, three times as many as back in 2011. Nearly 500 accounts have more than 25 million dollars. Buffett, who has historically supported higher taxes on the rich, had a Roth IRA valued at $ 20.2 million at the end of 2018.

Is Roth IRA backdoor worth it?

Backdoor Roth IRAs Are Worth It for Most High-Payers “Even if you pay taxes now in the top tax bracket (currently 37%, plus state taxes), this money will grow tax-free until retirement, when you are able to withdraw funds and pay no taxes, “says Abby Donnellan, a CPA and senior tax strategist at Moneta Group.

Are backdoor Roth IRAs allowed in 2021?

Backdoor Roth IRA Contribution Limit The IRA contribution limit for 2021-22 is $ 6000 per person, or $ 7000 if the account holder is 50 years or older. So if you want to open an account and then use the backdoor IRA method to convert your account to a Roth IRA, that’s the maximum you can contribute for those tax years.

Is a Roth IRA a good investment?

Roth IRAs are ideal retirement savings accounts if you are in a lower tax bracket now than you would expect to be in retirement. … Those who own the Roth IRA pay taxes on contributions, but enjoy tax-free withdrawals in retirement.

How much does a Roth IRA earn annually? Typically, Roth IRAs see an average annual return of 7-10%. For example, if you are under 50 and have just opened a Roth IRA, $ 6,000 in contributions each year for 10 years with a 7% interest rate will collect $ 83,095. Wait another 30 years and your account will grow to more than $ 500,000.

Can you lose money in a Roth IRA?

Yes, you can lose money in a Roth IRA. The most common causes of losses include: negative market fluctuations, penalties for early withdrawal and insufficient time to put together. The good news is that the more time you allow a Roth IRA to grow, the less likely you are to lose money.

Is a Roth IRA high risk?

But they should follow Thiel’s clue in one way: Roth accounts are a great place for high-risk, high-return investments. (Thiel has not commented on the report.) Unlike a traditional individual pension account or 401 (k), Roths is financed with dollars after tax.

Is money in Roth IRA protected?

Individual Retirement Accounts (IRAs), including Roth IRAs, are not protected by the federal government under ERISA. The only exception is in bankruptcy. … Outside of bankruptcy, state laws determine whether the money in an unqualified account is protected from creditors.

Is it better to invest in Roth IRA or 401k?

A Roth 401 (k) tends to be better for high-income earners, has higher contribution limits and allows for employer-matching funds. A Roth IRA allows your investments to grow longer, tends to offer more investment options and enables easier early withdrawals.

What is the downside of a Roth IRA?

An important drawback: Roth IRA contributions are made with money after tax, which means that there is no tax deduction in the contribution year. Another disadvantage is that withdrawal of account income does not have to be made until at least five years have passed since the first contribution.

What is the difference between a Roth IRA and 401k?

The main difference between a Roth IRA and 401 (k) is how the two accounts are taxed. With a 401 (k) you invest before tax, and lower your taxable income for that year. But with a Roth IRA, you invest after tax, which means your investments will grow tax-free.

Can you get rich from Roth IRA?

Some ultra-rich individuals have amassed hundreds of millions – or even billions – of dollars in tax-protected Roth individual retirement accounts, according to a report released Thursday by ProPublica, an investigative news agency.

Can you have two ROTH IRAs?

You may have multiple traditional and Roth IRAs, but your total cash contributions may not exceed the annual maximum, and your investment options may be limited by the IRS. IRA losses may be deductible. There is also no age limit for contributing to a Roth IRA.

Is it smart to have multiple Roth IRAs? Having multiple Roth IRA accounts is perfectly legal, but the total contribution you make to both accounts can still not exceed the federally set annual contribution limits.

Is it bad to have 2 IRAs?

There is no limit to the number of individual pension accounts (IRAs) you can own.

Is having 2 Roth IRAs illegal?

How Many Roth IRAs? There is no limit to the number of IRAs you can have. You can even own multiples of the same type of IRA, which means you can have multiple Roth IRAs, SEP IRAs and traditional IRAs. … You are free to divide that money between IRA types in a given year, if you wish.

Comments are closed.